Home

About Dan

Search Properties

Buying/Selling Tips

News & Links

Referrals

Contact Me

Home

About Dan

Search Properties

Buying/Selling Tips

News & Links

Referrals

Contact Me

daniel.peaper@longandfoster.com

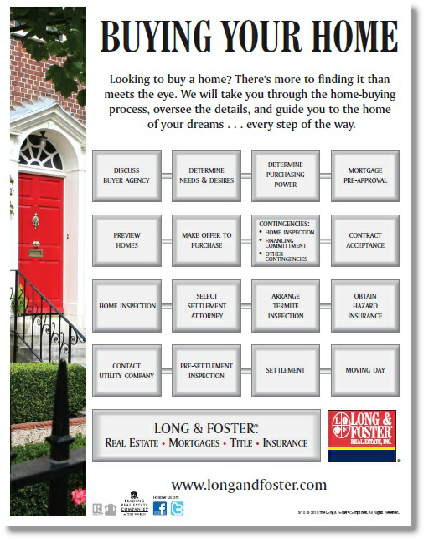

Home Buyers Guide (click on the home buying guide below to enlarge it)

Owning your own home is the American Dream. And that dream is more alive today than ever before. Yet one of the first realizations a prospective home buyer often comes to is that the "dream home" does not always seem affordable.

Buying a home has changed. Before, buyers usually shopped for the best house they could find, then "took out" a loan. Today, prospective buyers must shop as thoroughly as they can for the best financing as they do for the best house. In today's market,

both tasks are equally important.

Experience has taught me that the buying process

involves common stages for all home buyers. To help

you understand that process, and make the most of

every day and dollar you spend, Long & Foster®

Companies, Inc. has prepared this Home Buyers

Guide to provide an overview from the planning

table to the closing table.

How Much House?

House hunting begins at home—with planning. The

first step toward buying a house is to sit down.

Before you grab the road maps and hit the streets,

you need to do a little planning. I call it “pre-

qualifying”. Simply, it’s determining how much house

you can afford to buy. Knowing your affordable price

range will bring your house-

lenders, for a small “up-

required verification and pre-

mortgage, allowing you the opportunity to negotiate

as a preferred buyer.

How much house you can afford to buy depends on

two things: how much you can afford for the monthly

housing payment, and how much you can invest in

the down payment. Monthly payments include

principal and interest on the mortgage loan, and

property taxes and insurance against fire and other

hazards. These four costs are often abbreviated “P.I.T.I.”. For some buyers and lenders, monthly housing costs may also include homeowners association dues, condominium fees, and mortgage insurance.

What To Look For

Choosing a place to live can be one of the most exhilarating experiences

of a lifetime. Long and Foster has learned through the thousands of home seekers

they have helped that the best approach is to be prepared. Literally, to do some

homework. Our observation is simple. Your move can be an improvement if you duplicate

what you like in your present community and avoid what you dislike.

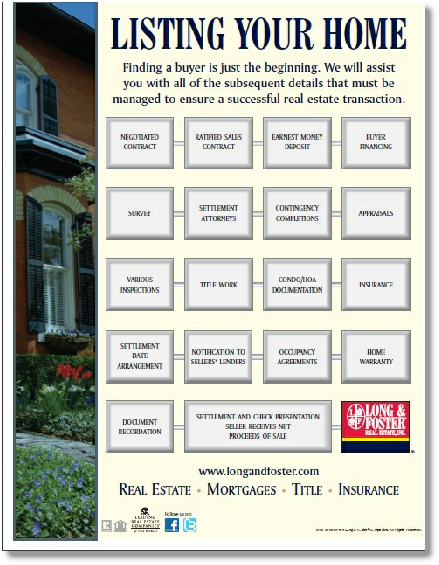

Home Sellers Guide (Click on the home sellers guide below to enlarge it)

There are a number of steps to selling any house. Experience has taught me that every

home sale is unique. Yet every sale — from putting the house on the market to settlement

day — shares a common process.

Long & Foster’s Home Sellers Guide is designed to help

you understand the selling process beforehand. This inside know-

Of course, this short guide cannot answer all your

questions.

For specific answers to your specific

situation, please email me at

daniel.peaper@longandfoster or call me at

443-

I will be happy to share my expertise. After all, I

want you to get the best selling price in the shortest

time. Every advantage is yours when you do business

with Long & Foster, The Real Edge in Real Estate®.

Clean Up, Fix Up, Or Toss Out

Today, the home that stands out among similarly-

priced houses is the home that sells. Why? Because

it makes a good first impression that lasts right to

the settlement table.

You may not be able to improve the market value of

your house (finish basement, remodel kitchen, etc.),

but you can improve its marketability. And usually

This can be done with more elbow grease than hard

cash. The key is to put yourself in the buyer’s shoes. In fact,

if you drop by some open houses (you may soon be a

buyer yourself), you’ll pick up some pointers. Then

practice making your house as appealing and

uncluttered as the home you wish to buy.

Leave The Selling To Me

While the home seller is actively getting the house

ready to show, the listing broker is actively spreading

the word that the property is available. Generally

speaking, the listing is promoted to two groups: the

real estate community and the buying public.

Many home sellers are surprised to learn

that approximately 56% of all buyers come from referrals between brokers and their

vast network of contacts. Approximately 17% of buyers come from inquiries stimulated

by “for sale” signs in yards. The remaining 27% of buyers come from a combination

of the real estate company’s reputation and image, open houses, and advertising or

other promotional efforts. Obviously, the most productive source of buyers is working

closely with other brokers, and this is where your listing broker begins.

Signing On The Dotted Line

A buyer makes an offer by submitting a written and signed

offer to purchase, which will become the sales contract when ratified by everyone’s

signature. Once the seller and buyer sign the paper, they are bound by the contract

conditions.

The “presentation of a contract” begins when the selling broker registers

the offer with the broker’s own office and notifies the listing broker of the offer.

The listing broker then arranges a presentation appointment with the home seller,

and with the selling broker in some areas. (The buyer doesn’t attend the presentation.)

Either the selling broker or the listing broker presents the terms of the offer,

depending on local customs. The listing broker acts as the home seller’s advisor.

Part of the presentation is determining that the buyer is qualified financially to

make the purchase. (Should either the seller or buyer be out of town, the contract

is presented via telephone and confirmed later by FAX.)